(Posted November 2024)

As a Canadian CPA, you are required to complete a prescribed minimum number of Continuing Professional Development (CPD) hours annually and for the rolling three-calendar-year (triennial) period:

- Each year, you must complete 20 CPD hours and at least 50%, or 10 hours, must be verifiable.

- Over the rolling triennial period, you must complete 120 CPD hours and at least 50%, or 60 hours, must be verifiable.

- Of those 60 verifiable hours, at least 4 CPD hours must pertain to professional ethics.

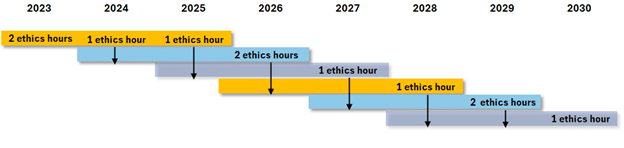

You can accumulate the four hours through ethics components in any number of seminars or courses. You do not have to obtain the four ethics CPD hours in a single four-hour program. Also, the four hours do not have to be completed in a single calendar year if you meet the requirement during the rolling triennial period.

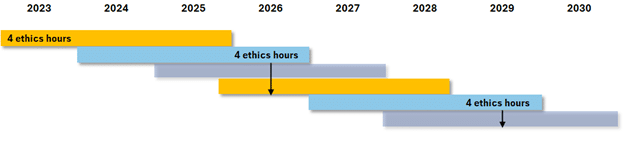

For example, you could complete 4 ethics hours every three years to satisfy the triennial requirement as follows:

Another way you could meet the requirements would be to spread out your ethics hours as follows:

To count towards your CPD requirements, the professional ethics hours must be relevant to your professional responsibilities and competencies as a CPA. It is your responsibility to determine whether the professional ethics CPD provides new learning that develops and maintains professional competence to enable you to continue to perform your professional role.

To meet your CPD requirements, the professional ethics learning activities must go beyond an awareness of the law, standards or guidelines. They must address the application of ethical principles or theories to those laws, standards, or guidelines. Examples of topics related to professional ethics and ethical decision-making include:

- Anti money-laundering

- Bribery and corruption

- Corporate codes of conduct

- Corporate social responsibility

- Doing the right thing

- Ethical decision-making, approaches, thinking, and case studies

- Ethical business culture

- Ethics in technology

- Fraud prevention

- Honesty in business practice

- Independence/conflict of interest

- Professional conduct

- Regulatory updates covering the CPABC Act, Bylaws, Bylaw Regulations, and Code of Professional Conduct by your provincial CPA body

- Regulatory updates that are relevant and appropriate to your role or industry

- Reputation and risk

- Whistleblowing

You must also have documentation from an independent provider to confirm your verifiable CPD hours. Verifiable CPD activities include:

- Continuing education

- Instruction/speaking

- Committees

- Research and publications

For more detailed information about the differences between verifiable and non-verifiable CPD activities, you can read this blog. You can also contact your provincial CPA body if you have any questions about your CPD requirements.

You do not want to get caught on December 31 realizing that you still need those four professional ethics CPD hours. Densmore can help you meet your CPD requirements, including ethics, with our asynchronous CPD courses.